Aspen Reserve Specialties subscribes to the CAI National Reserve Study Standards. By these standards, a Reserve Study is comprised of two parts: the financial analysis and the physical analysis. The financial analysis section includes information on the current status of the reserve fund and recommendations for the future life of the fund. The physical analysis section refers to the current conditions and estimated replacement cost for the individual common area components.

Physical Analysis

The Physical Analysis based around “site inspection”. When inspecting the property, Aspen Reserve Specialties will analyze all of the association’s “common area components” to determine which components warrant funding.

Financial Analysis

The Financial Analysis provides information on the current status of the reserve fund and recommendations for the future life of the fund.

The physical analysis is the cornerstone of the Reserve Study. It is based around the “site inspection.” When inspecting the property, Aspen Reserve Specialties will analyze all of the association’s “common area components” to determine which components warrant reserve funding.

Four Point Test

Generally speaking, a reserve component must pass a four-point test (designated by the CAI National Standards) in order to qualify for reserve funding.

The following are the four points:

- Must be a common area asset.

- Must have a limited life-span.

- Must have a predicatble remaining useful life.

- Must have a minimum threshold cost.

Once a reserve component has been identified the following must be determined for each component:

- Useful Life

- Remaining Useful Life

- Current Replacement Cost

After this information is recorded during the site inspection, it is verified or refined through research with the association’s vendors or other experts. Once all of an association’s reserve components are identified and their life and cost estimates determined a financial analysis can be performed.

The financial analysis section of a Reserve Study uses the cost and life estimate information gained from the physical analysis to come up with a funding plan that provides for each component’s reserve funding needs.

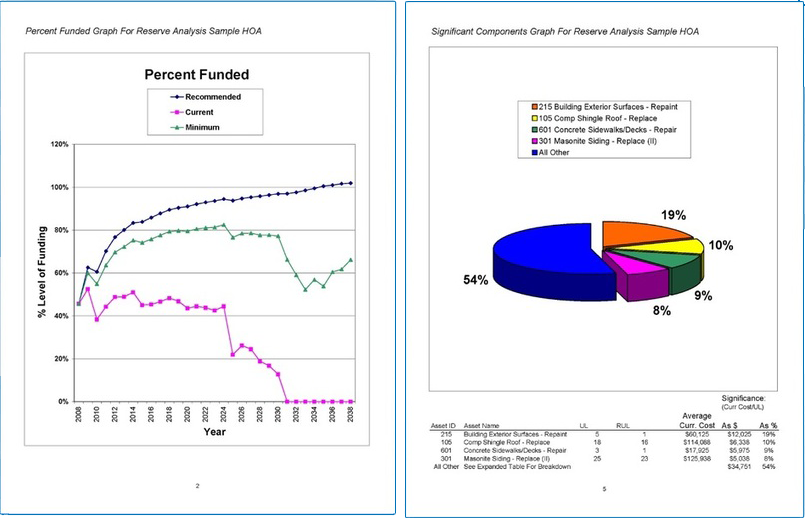

The present status of the Reserve Fund is generally expressed in terms of “Percent Funded.” The amount that an association should ideally have in its reserve fund (according to the most recent reserve study) is called the Fully Funded Balance. The percentage of the actual amount in the reserve fund versus the ideal is said to be the account’s percent funded. For instance an association with an actual reserve fund balance of $50,000 and a theoretical fully funded balance of $100,000 is said to be 50% funded.

The present status of the Reserve Fund is generally expressed in terms of “Percent Funded.” The amount that an association should ideally have in its reserve fund (according to the most recent reserve study) is called the Fully Funded Balance. The percentage of the actual amount in the reserve fund versus the ideal is said to be the account’s percent funded. For instance an association with an actual reserve fund balance of $50,000 and a theoretical fully funded balance of $100,000 is said to be 50% funded.

How is the Fully Funded Balance Calculated?

Simply put, the formula for the fully funded balance is:

FFB=Current Cost* Effective Age/Useful Life

Where:

Current Cost = the current cost of any reserve component project

Effective Age = the current age of the component adjusted for current condition – expressed as a fraction of the useful life

([Useful Life – Remaining Useful Life]/Useful Life)

For example:

If a reserve project has a useful life of 5 years and a current cost of $5,000, then the association needs to put aside $1,000 a year towards the future cost of that project ($1,000/year for 5 years = $5,000 total project cost). If that reserve component is 2 years old then the reserve fund should already have 2/5 of the project cost or $2,000 towards the future project cost.

This calculation is repeated for each component. The sum of the individual reserve requirements is said to be the fully funded balance.

Once the present status if the reserve fund is determined, a sound funding plan must be put together. Generally speaking, when putting together a funding plan, there are four “Funding Principles” (CAI National Reserve Study Standards) that should be considered:

Sufficient funds when required

A sound funding plan must provide enough cash when

necessary to meet the needs of each reserve component.

Stable contribution rate over the years

A funding plan should not require reserve contributions that vary greatly from year to year. Ideally a funding plan should recommend one monthly contribution (with increases to offset inflation) for the entire 30 year period.

Fiscally responsible

Any funding plan should be prudent and financially sound.

Evenly distributed contributions over the years

Ideally the reserve contributions should be allocated evenly between the association’s present and future funding needs. Placing the reserve contribution needs solely on the present or future owners would put undue burden upon them